Backside line: Can individuals flourish in a strain cooker atmosphere? Not solely is it doable, however Nvidia’s staff are proving that such working situations also can drive efficiency – a minimum of within the quick time period. However because the GPU big seems to the longer term, it might wish to contemplate totally different insurance policies and domesticate a company tradition that encourages extra stability for its overworked, exhausted (and uber rich in some instances) staff.

In a tech business typically characterised by grueling hours and substantial private wealth, Nvidia would possibly stand out as an excessive instance.

Because the daybreak of 2019, Nvidia’s inventory worth has skyrocketed by an astonishing 3,776%, a testomony to its pivotal position within the synthetic intelligence revolution. This meteoric rise has not solely remodeled the corporate’s monetary panorama but additionally turned lots of its staff into multimillionaires, as evidenced by the luxurious autos – Porsches, Corvettes, and Lamborghinis – lining the parking tons at its headquarters.

Regardless of this newfound wealth, Nvidia staff face a demanding work atmosphere that leaves little room for leisure, in response to a profile of the corporate by Bloomberg. The tradition is formed by its visionary founder and CEO, Jensen Huang, who’s famend for his relentless drive and excessive expectations. Huang has cultivated an environment of “scrappiness and overworking,” the place staff are pushed to their limits in pursuit of excellence.

This pressure-cooker atmosphere is characterised by a chaotic organizational construction, with managers typically overseeing dozens of direct stories. Huang’s philosophy eschews layoffs in favor of what he describes as “torturing them into greatness,” fostering a tradition the place stress and confrontation are commonplace.

Present and former staff describe grueling work schedules, typically extending to seven days every week and late nights. The high-pressure atmosphere is additional intensified by frequent confrontations throughout conferences. But, regardless of these challenges, the profitable compensation packages – typically dubbed “golden handcuffs” – make it troublesome for workers to depart. Nvidia’s inventory grant system, which generally vests over 4 years, offers a powerful incentive for workers to stay with the corporate and reap the complete advantages of their compensation.

Nvidia’s means to retain its expertise is mirrored in its remarkably low turnover charges. In 2023, the corporate’s worker turnover was simply 5.3%, dropping to 2.7% after Nvidia’s valuation soared previous the $1 trillion mark. This can be a stark distinction to the semiconductor business’s common turnover charge of 17%.

Not like the tech business trope of “resting and vesting,” the place staff coast whereas ready for his or her inventory to vest, Nvidia frowns upon such conduct. Workers who try to coast are topic to inside criticism, as illustrated by a employees assembly the place complaints had been raised about colleagues in “semiretirement” mode.

Nvidia’s monetary success has led to conspicuous shows of wealth amongst staff, lots of whom have amassed substantial fortunes, buying trip houses and attending high-profile occasions just like the Tremendous Bowl and NBA Finals. Discussions about these luxurious purchases have change into commonplace amongst staff, no matter their seniority.

This wealth disparity is additional highlighted by the inventory holdings of Nvidia’s Chief Monetary Officer, Colette Kress, who owns inventory price roughly $758.7 million – considerably greater than these of her counterparts at Intel and AMD, regardless of their bigger pay packages.

As Nvidia’s newest earnings report signifies, the corporate’s monetary success exhibits no indicators of slowing down.

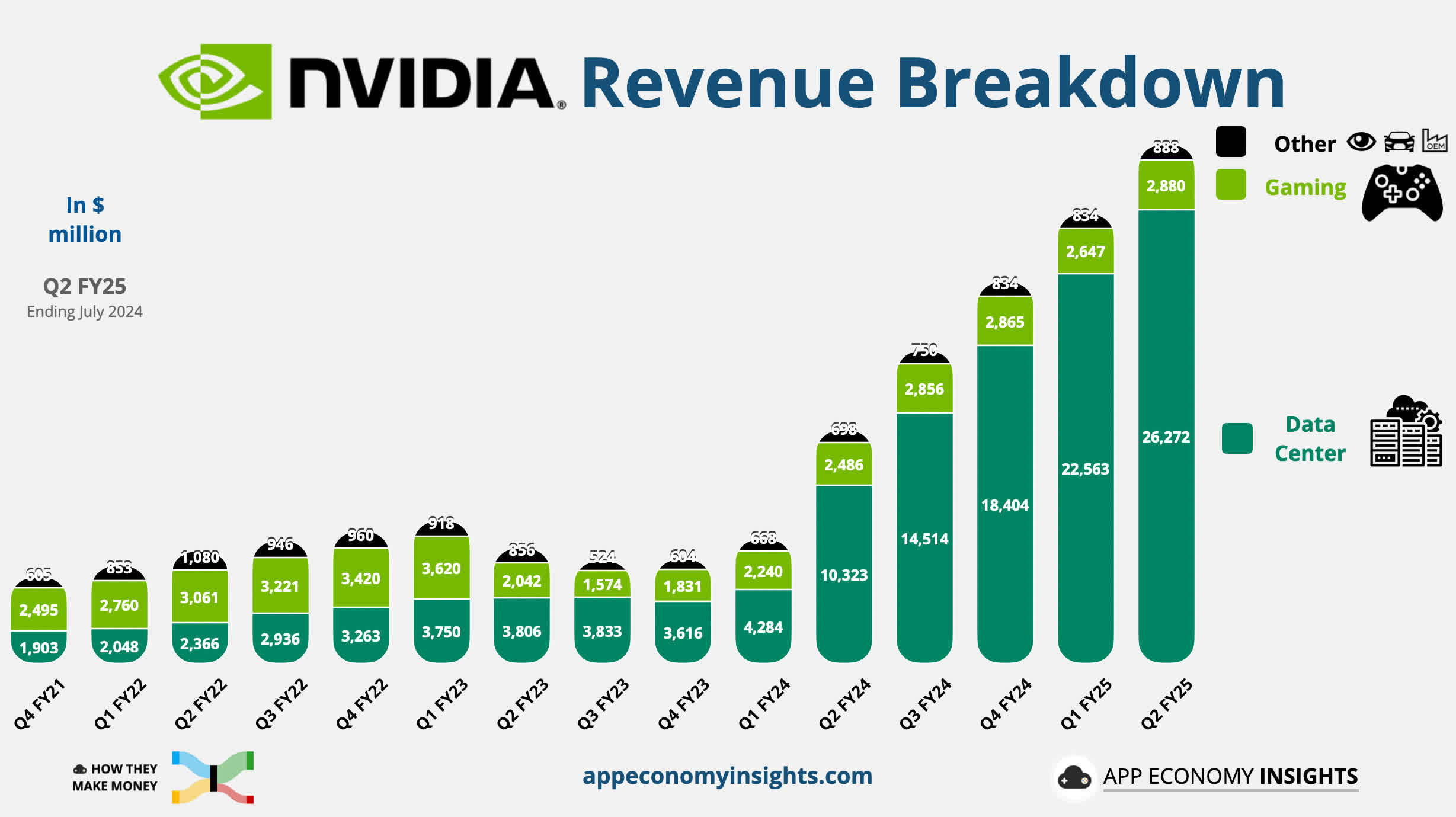

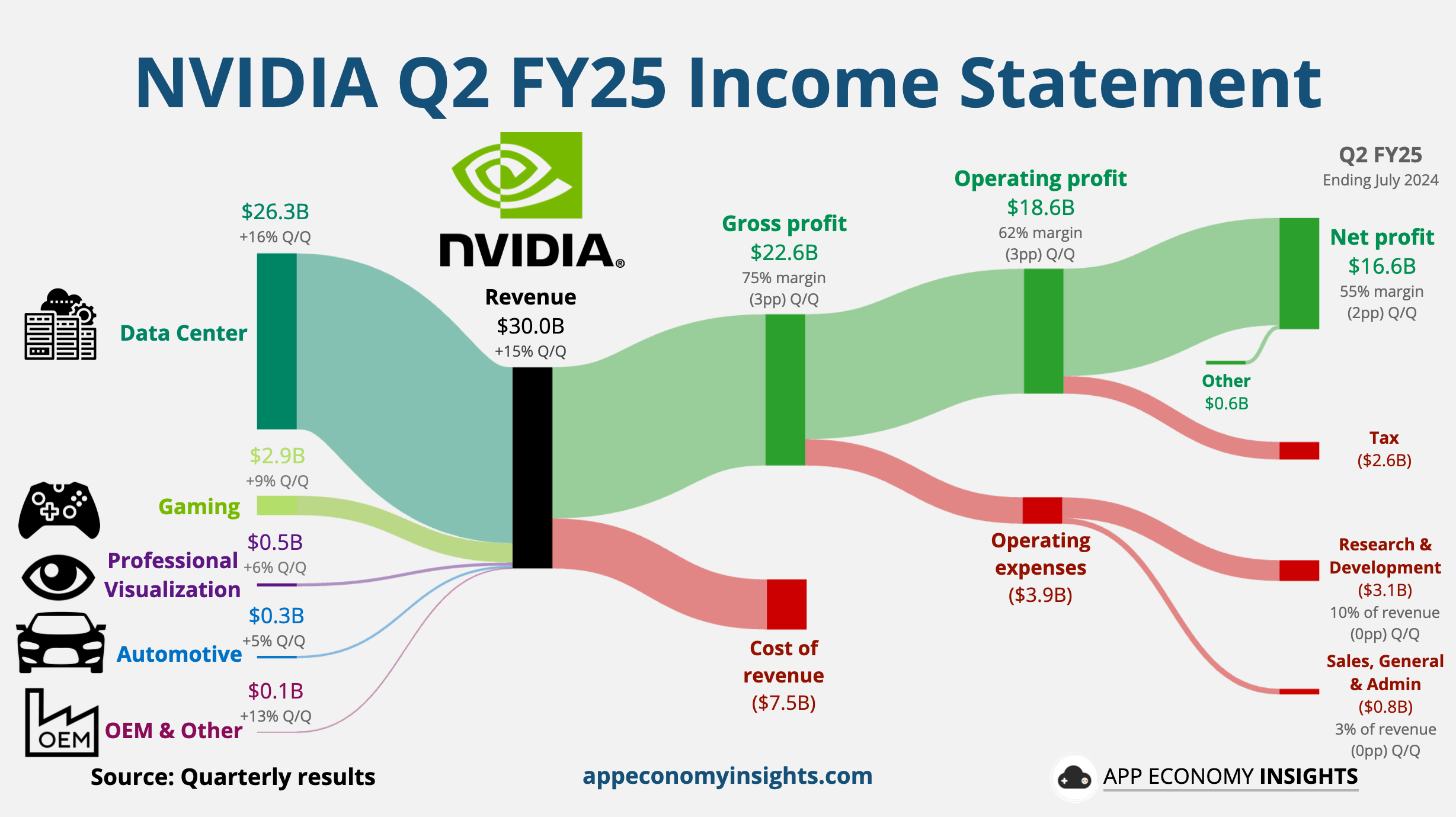

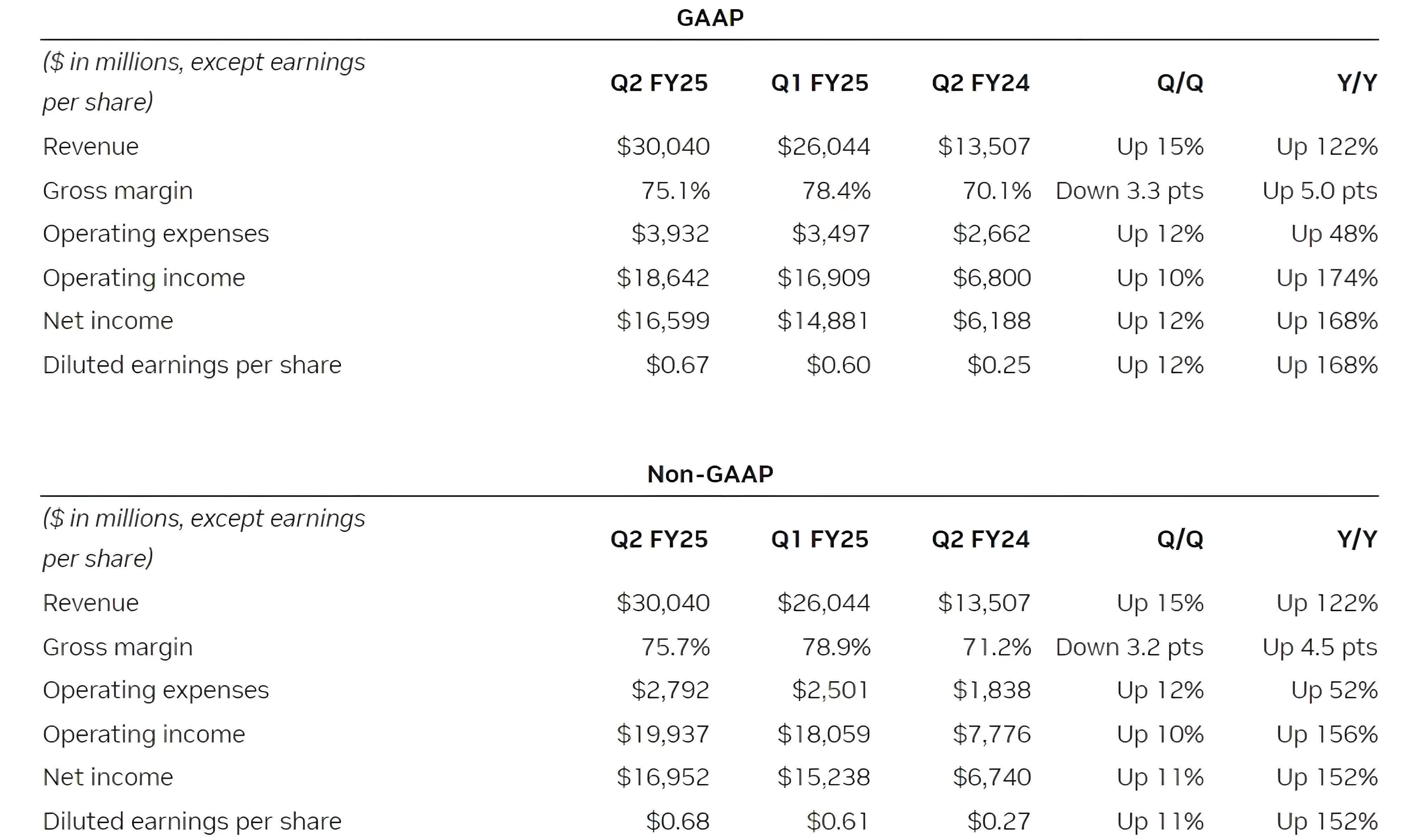

Nvidia achieved an all-time document quarterly income of $30.04 billion for the second quarter of its fiscal 2025, marking a outstanding 122% improve year-over-year and a 15% improve quarter-over-quarter. This progress is primarily pushed by unprecedented demand for AI GPUs.

The corporate’s web earnings for the quarter was $18.642 billion, representing a ten% sequential improve and a considerable 174% improve in comparison with the identical quarter within the earlier 12 months. Nvidia’s gross margin for the quarter was reported at 75.1%, a 5% improve from Q2 FY2024, though it was 3.3% decrease than Q1 FY2025 because of the manufacturing of a low-yield Blackwell design in preparation for an upcoming product launch.

Nonetheless, Nvidia’s steering for the third quarter introduces a be aware of warning. The corporate initiatives gross sales of roughly $32.5 billion, with GAAP and non-GAAP gross margins anticipated to be 74.4% and 75.0%, respectively.

Regardless of excessive margins, Wall Road analysts have expressed concern over the modest income progress prediction. This cautious steering could also be influenced by provide constraints, notably concerning TSMC’s means to supply adequate processors to satisfy the hovering demand for Nvidia’s Hopper and Blackwell merchandise.